Maximize Travel Rewards with Chase Ink Business Cards: Earn Points and Transfer to Travel Partners

Affiliate Disclosure: This post may contain affiliate links, which means I may earn a small commission at no additional cost to you if you make a purchase through these links. I only recommend products and services I trust and believe will benefit you. I do not sell your personal information, and all opinions expressed in this post are my own.

Editorial Disclosure: Opinions expressed here are the author's alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved, or otherwise endorsed by any of the entities included within the post..

Nicole is a mom, wife, travel enthusiast, teacher, and audiobook nerd ready to show you how to travel for nearly free using points and miles!

Watch Points and Miles Teachers Introduction to Traveling for Nearly Free MasterClass

Transfer Partners Guide

Complete guide to Chase, American Express, Capital One and Citi transfer partners and how to use them.

DOWNLOAD NOW

About Nicole

August 5, 2024

Chase offers several Ink Business credit cards that can help you earn Chase Ultimate Rewards points quickly. These points can be transferred to travel partners like Hyatt, Southwest, and United for free travel. Let’s review the top three Chase Ink Business Cards and show you exactly how to use them for booking travel with points.

The Chase Ink Business Credit Cards Overview

Chase offers four business cards in its Ink suite, but today we’ll focus on three of them:

- Chase Ink Business Cash® Credit Card

- Chase Ink Business Unlimited® Credit Card

- Chase Ink Business Preferred® Credit Card

These cards are crucial in my points and miles strategy. They earn valuable Chase Ultimate Rewards points, which can be used for travel redemptions and much more. Plus, they don’t require a “traditional business” to apply—just a side hustle or even a small personal business can qualify.

Chase Ink Business Cards: Benefits and How They Earn Points

1. Chase Ink Business Cash® Credit Card: $0 Annual Fee

- Huge welcome bonus!

- Why it’s great for families: With no annual fee, this card provides a high rewards rate in categories like office supplies, which can be useful for everyday purchases and work-related expenses.

2. Chase Ink Business Unlimited® Credit Card: $0 Annual Fee

- Huge welcome bonus!

- Why it’s great for families: This card is straightforward and simple, earning 1.5x points on all purchases. Great for those who don’t want to worry about tracking spending categories.

3. Chase Ink Business Preferred® Credit Card: $95 Annual Fee

- Huge welcome bonus!

- Earn Points:

- 3x points on the first $150,000 spent in combined purchases at travel, advertising, internet, cable, and phone services each anniversary year.

- 1x point on all other purchases.

- Why it’s great for families: This card earns 3x points on business-related purchases, making it a powerful tool for maximizing points if you travel often or run a side business.

Does NOT Take a 5/24 Spot

Many cards, business cards included, will take up a 5/24 spot. As long as you are 4/24 or under, you can apply for the Chase Ink Business Preferred® Credit Card, Chase Ink Business Cash® Credit Card, Ink Business Unlimited® Credit Card, or any of the other Chase Business Cards, and it does not count towards a spot in your 5/24.

This benefit is great, considering Chase has this frustrating rule that only allows you to apply for five new lines of credit in 24 months. Business cards are an excellent strategy for maximizing your points and miles.

Why Use These Cards for Travel Points?

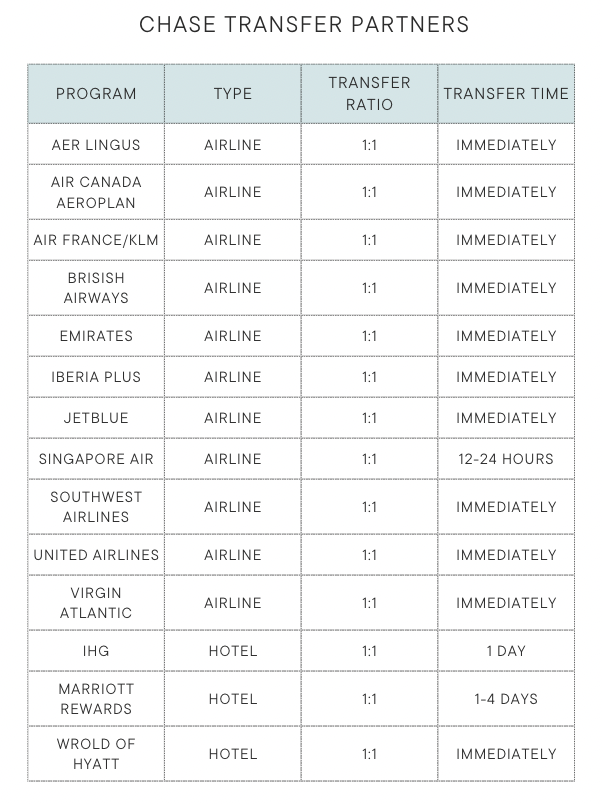

All Chase Ink Business Cards earn Chase Ultimate Rewards points, which can be transferred to 14 travel partners, including 11 airlines and 3 hotel chains. These points can be used to book free flights, hotel stays, and car rentals with top travel brands like Hyatt, Southwest Airlines, and United Airlines. You can even use these points for family vacations to destinations that might otherwise be out of your budget.

Benefit: When you pair any of these cards with a Chase Sapphire Preferred® or Chase Sapphire Reserve® card, you unlock even more travel benefits, such as 1.25x or 1.5x points on travel redemptions through the Chase Travel booking portal(depending on your Sapphire card) and the ability to combine points across multiple Chase accounts.

How to Redeem Chase Ultimate Rewards with Transfer Partners: Specific Examples & Step-by-Step Directions

Chase Ultimate Rewards points are highly versatile and can be transferred to 14 travel partners, including Hyatt, United Airlines, Southwest Airlines, and British Airways, among others.

This makes it easy to book free flights, hotel stays, and car rentals for your next trip, especially if you know how to transfer and redeem them effectively. Below, I’ll walk you through how to use your points for hotel stays and flights with examples, plus step-by-step directions for the booking process.

Redemption Example 1: Booking a Hyatt Hotel Stay with Chase Ultimate Rewards

Scenario: You want to book a Hyatt hotel for a family trip to Key West, and the best option is a Category 3 Hyatt hotel, which typically costs 12,000-15,000 points per night.

Step-by-Step Directions:

- Earn Chase Ultimate Rewards Points

Start by earning Chase Ultimate Rewards points with your Chase Ink Business Cash®, Chase Sapphire Preferred®, or other Chase cards that earn Ultimate Rewards points. - Combine Your Points

If you have points spread across different Chase accounts (e.g., from a business card and a personal card), log into your Chase Ultimate Rewards account and combine your points into one account. To do this:- Log into your Chase account.

- Go to the Ultimate Rewards section.

- Click on Combine Points and select the cards you want to combine.

- Transfer Points to Hyatt

Once your points are in your Chase Sapphire or Ink Business account, you can transfer them to Hyatt:- From the Ultimate Rewards dashboard, click on Transfer to Travel Partners.

- Select Hyatt as your transfer partner.

- Enter your Hyatt World of Hyatt account number (you’ll need to create a free Hyatt account if you don’t have one).

- Choose how many points to transfer. Note: Transfers to Hyatt happen in 1,000-point increments.

- Book Your Hyatt Stay

After transferring your points, go to the Hyatt website or the World of Hyatt app. Here’s how:- Search for the hotel (e.g., Hyatt Centric Key West Resort & Spa).

- Select the “Book with Points” option.

- Choose your check-in and check-out dates.

- Apply your transferred points to book the stay (e.g., 12,000 points per night for a Category 3 hotel).

Example: Booking a Hyatt Centric Key West

- Room cost: 12,000 points per night.

- You have 36,000 points (enough for 3 nights).

- Book your stay directly on the Hyatt website or app using your transferred points.

Redemption Example 2: Booking a United Airlines Flight with Chase Ultimate Rewards

Scenario: You want to book a flight to New York for your family, and a United Airlines flight is available for 25,000 miles (one-way) in economy class.

Step-by-Step Directions:

- Earn Chase Ultimate Rewards Points

Just like the hotel booking example, start earning points with a Chase card that earns Ultimate Rewards points, such as the Chase Sapphire Preferred® or Chase Ink Business Preferred®. - Combine Your Points

If your points are spread across different Chase accounts, follow the same steps as before to combine them into one account. - Transfer Points to United Airlines

To book the United Airlines flight, you need to transfer points to United MileagePlus:- Log into your Chase Ultimate Rewards account.

- Navigate to Transfer to Travel Partners.

- Select United Airlines from the list of transfer partners.

- Enter your United MileagePlus account number (create a free account if you don’t have one).

- Choose how many points you want to transfer. For this example, you need 25,000 points for a one-way flight.

- Book Your United Flight

After transferring your points to United MileagePlus, go to United.com:- Search for the flight you want (e.g., from Los Angeles to New York).

- Choose your flight and proceed to payment.

- Select the miles option for payment and apply your transferred 25,000 miles to book the flight.

Example: Booking a United Airlines Flight

- Flight cost: 25,000 miles (one-way, economy).

- You have 30,000 Chase Ultimate Rewards points (enough for 1 one-way flight).

- Book the flight directly on United’s website using your transferred points.

Redemption Example 3: Booking a Southwest Airlines Flight

Scenario: You want to fly to Chicago for a weekend getaway, and Southwest Airlines has a flight for 16,000 Rapid Rewards points (one-way).

Step-by-Step Directions:

- Earn Chase Ultimate Rewards Points

Just like the previous examples, earn points using your Chase Sapphire or Chase Ink Business cards. - Combine Your Points

Combine your points into one account if you have them spread across different Chase cards. - Transfer Points to Southwest Airlines

To book the Southwest flight, transfer your points to Southwest Rapid Rewards:- Log into your Chase Ultimate Rewards account.

- Click on Transfer to Travel Partners.

- Select Southwest Airlines Rapid Rewards.

- Enter your Southwest Rapid Rewards account number.

- Choose how many points to transfer. For this flight, you need 16,000 points.

- Book Your Southwest Flight

After transferring your points, go to Southwest.com:- Search for your flight (e.g., from Denver to Chicago).

- Select your flight and proceed to payment.

- Choose to pay with Rapid Rewards points and apply your transferred 16,000 points.

Example: Booking a Southwest Airlines Flight

- Flight cost: 16,000 points (one-way).

- You have 20,000 Chase Ultimate Rewards points (enough for one way).

- Book the flight directly on Southwest’s website using your transferred points.

Key Tips for Booking Travel with Chase Ultimate Rewards Points

Consider Booking With Family: If you have multiple people in your household, combine points across accounts to reach the amount you need for booking flights or hotel stays.

Use the Chase Ultimate Rewards Travel Portal: If you don’t want to transfer points to airlines or hotels, you can use your points to book travel directly through the Chase Ultimate Rewards Travel Portal. The Chase Sapphire Reserve® card offers 1.5 cents per point in value for travel redemptions, while the Chase Sapphire Preferred® offers 1.25 cents per point.

Check for Award Availability: Make sure there’s award availability before transferring your points. Transferring points to a partner airline or hotel is usually irreversible, so it’s important to confirm you can book the flight or hotel before completing the transfer.

Step 1: Earn Chase Ultimate Rewards Points

To earn Chase Ultimate Rewards points, use your Chase Ink Business card for everyday purchases like gas, office supplies, or dining. Here’s how the points accumulate:

- 5x points for office supplies (Business Cash card)

- 3x points on travel (Business Preferred card)

- 1.5x points on all purchases (Business Unlimited card)

- Sign-up bonus: Each card has a generous bonus when you meet the required spending threshold.

Step 2: Combine Your Points Across Cards

Once you’ve accumulated points on your Chase Ink Business cards, you can combine points into one account, typically your Chase Sapphire account (Preferred or Reserve). Here’s how:

- Log in to your Chase account.

- Go to the Ultimate Rewards section.

- Click on Combine Points.

- Choose the cards you want to combine points from and confirm the transfer to one account.

This allows you to pool all your points into one place for larger redemptions.

Step 3: Transfer Points to Travel Partners (e.g., Hyatt, Southwest, United)

Once your points are combined, you can easily transfer them to any of Chase’s 14 travel partners for award bookings. Here’s how:

- Log in to your Chase account.

- Go to the Ultimate Rewards section.

- Click on Transfer to Travel Partners.

- Choose Hyatt (or your preferred travel partner).

- Enter your Hyatt account number (or the account number of another transfer partner).

- Select how many points you want to transfer. Transfers to Hyatt happen in 1,000-point increments.

Example: You can use 30,000 Chase Ultimate Rewards points to book a free night at a Category 3 Hyatt hotel like the Hyatt Centric Key West Resort & Spa—perfect for a family vacation!

Side Hustles that Qualify for a Business Card

Many people think they can’t apply for a business card, but almost everyone can qualify for a Chase Ink Business Card. A “business” can be any activity that earns income—even a side hustle. Here are examples of side hustles that qualify:

- Photography

- Coaching or tutoring

- Babysitting

- Selling items on Facebook Marketplace

- Fitness instructor

- Selling beauty products

- Lawn care or pet sitting

Even if your side hustle only brings in a few hundred dollars a year, you may still qualify to apply!

Need additional help, check this out.

How to Apply for a Business Card as a Sole Proprietor

Final Thoughts

Whether you’re new to Chase Ultimate Rewards or you’ve been collecting points for a while, Chase Ink Business Cards are an excellent way to earn points that can be transferred to travel partners. These cards offer great sign-up bonuses, flexible points, and no annual fees (on two of the cards). If you’re looking to book free travel for your family using points, these cards are a must-have in your wallet.

Key Takeaways:

Apply for a business card even if you have a side hustle like babysitting, tutoring, or selling online.

Earn Chase Ultimate Rewards points with the Chase Ink Business Cash®, Ink Business Unlimited®, or Ink Business Preferred® cards.

Transfer points to top travel partners like Hyatt, Southwest, and United for free flights, hotel stays, and more.

No annual fee on the Ink Business Cash® and Ink Business Unlimited® cards, making them a great choice for those starting their points journey.

Watch it Now

Opinions expressed here are the author's alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.

I found out about points and miles accidentally.

I was researching index funds and happened upon the points and miles community through creators who also post about budgets, financial independence, and investing.

Points and miles allowed those people to travel and work toward financial independence simultaneously.

Thank goodness I got started when I did. The past almost two years of travel have been something we will never forget.

Earning points and miles through credit cards is only a good choice if you have the financial discipline to use them, like cash/debit cards.

Since we started traveling with points and miles, we have had more money going into our investment and savings accounts than ever.

Now I'm excited to teach you!

Welcome

I am excited you are here

New to points and miles? START HERE!