7 Expensive Family Travel Experiences — and Smarter Ways to Save Big

Affiliate Disclosure: This post may contain affiliate links, which means I may earn a small commission at no additional cost to you if you make a purchase through these links. I only recommend products and services I trust and believe will benefit you. I do not sell your personal information, and all opinions expressed in this post are my own.

Editorial Disclosure: Opinions expressed here are the author's alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved, or otherwise endorsed by any of the entities included within the post..

Nicole is a mom, wife, travel enthusiast, teacher, and audiobook nerd ready to show you how to travel for nearly free using points and miles!

Watch Points and Miles Teachers Introduction to Traveling for Nearly Free MasterClass

Transfer Partners Guide

Complete guide to Chase, American Express, Capital One and Citi transfer partners and how to use them.

DOWNLOAD NOW

About Nicole

American Express Membership Rewards, Capital One, Chase Ultimate Rewards, Citi ThankYou Points, Credit Card Benefits, Save on Experiences, Uncategorized

October 6, 2025

Family vacations are where some of our best memories are made — but let’s be real, they can also drain your wallet fast. Between park tickets, guided tours, and resort add-ons, it’s easy to feel like staying home and ordering takeout is the smarter choice.

Here’s the good news: you don’t have to skip the fun stuff to travel affordably. You just need the right strategy. At Points and Miles Teachers, I show families how to turn smart credit card use and rewards points into dream trips that cost less — and sometimes even nothing at all.

Today, I’m breaking down seven of the priciest family experiences — and showing how to make them far more affordable using points, perks, and insider tricks that actually work for real families.

1. Theme Park Tickets

Why it’s pricey:

- A single day at major parks like Disney or Universal can easily cost $600+ for a family of four — and that’s before food, parking, or souvenirs.

- Add multi-day tickets or park-hopper upgrades, and costs can soar even higher.

How to save smarter:

- Stack annual passes with free night certificates

- Instead of one long (and expensive) vacation, plan two shorter trips using free hotel nights from your travel rewards cards.

- Splitting up your park days helps you stretch an annual pass further and save hundreds on lodging.

- Many nearby hotel programs also include perks like early park entry or shuttle service, which adds even more value.

- Buy discounted gift cards

- Grocery stores and warehouse clubs often sell Disney, Universal, and other park gift cards at a discount.

- Pay with a credit card that earns 4–5x points on groceries, then use those gift cards for tickets, dining, or souvenirs inside the parks.

- Stack this with store promotions (like 4x fuel points or cashback weeks) for extra savings.

- Use Capital One Miles to offset park tickets

- Once you’ve earned Capital One Miles, you can redeem them using the Purchase Eraser to reimburse yourself for travel expenses — including theme park tickets.

- To ensure the purchase codes as travel (not entertainment), buy through trusted third-party sellers like Theme Park Frog or Get Away Today.

- This allows you to book tickets now and erase the charge later using miles.

- For more details on earning and redeeming, check out my Complete Guide to Capital One Miles.

2. Guided Excursions or Tours

Why it’s pricey:

- Guided snorkeling excursions or sightseeing tours can easily cost $300+ for a family, especially when you add transportation, equipment rentals, or lunch.

- Many travelers overpay for experiences that can often be done independently for a fraction of the cost.

How to save smarter:

- Book through travel portals with cash-back multipliers

- When booking through Viator, GetYourGuide, or similar sites, always check Rakuten or Capital One Shopping for bonus cash back — sometimes 10–15% back.

- It’s an instant rebate on something you were already planning to do, and you can stack it with your travel card’s bonus points.

- Book directly with local guides

- Many small operators offer better pricing when you book through Instagram, Facebook, or WhatsApp rather than big booking platforms that charge them heavy fees.

- Paying cash (or via a local payment app like Venmo or Revolut, depending on the destination) can sometimes score an off-menu discount while supporting local businesses directly.

- Find free or low-cost snorkel spots on your own

- Ask locals (especially dive shops or hotel staff) where they go on their days off — they’ll often share lesser-known beaches with great visibility and coral.

- Search on Google Maps, AllTrails, or Reddit for verified snorkel spots labeled with reviews and parking info.

- In Hawaii, Mexico, and much of the Caribbean, many top reefs are just a short swim from shore, meaning you don’t need to pay for a tour at all.

- Bring your own snorkel gear

- Packing your own set saves $20–$40 per person per day on rentals — and ensures a clean, comfortable fit.

- Look for lightweight travel snorkel sets from Cressi, U.S. Divers, or Decathlon — often under $40 and compact enough for carry-on luggage.

- If you’d rather buy on arrival, check local sporting goods stores or beach shops instead of hotel gift shops, which often double the price.

- Always pay with a travel rewards card

- Use a card that earns 3–5x points on travel or entertainment purchases to maximize rewards.

- Many premium cards also include trip delay or cancellation protection, so if weather cancels your tour, you’re covered automatically.

3. Ski Lift Tickets & Rentals

Why it’s pricey:

- Between lift passes, gear rentals, and lessons, ski days can easily cost $150–$200+ per person—before you even stop for lunch.

- Multi-day trips can quickly add up to thousands, especially at major resorts.

How to save smarter:

- Book ski resorts with points:

- Brands like Hyatt, Marriott, and IHG have ski-friendly properties in top destinations such as Park City, Vail, and Lake Tahoe.

- Using points not only saves on lodging but can unlock daily resort credits, breakfast, or lift vouchers at select properties.

- Example: Hyatt’s Alila and Destination properties often include credits that offset rentals or après-ski dining.

- Prepay through your travel portal or program:

- Use your card’s travel portal or partner site (Amex, Chase, or Capital One) to book lift tickets, lessons, or rentals in advance.

- These purchases often trigger statement credits or bonus points, reducing your total cost.

- Some resorts also offer early-bird or multi-day discounts when you buy tickets online before arrival.

- Take advantage of card protections and perks:

- Premium travel cards like the Chase Sapphire Preferred® and Reserve® include trip delay and interruption coverage, so if weather shuts down lifts or flights, you’re protected.

- Some cards also provide rental gear insurance or reimbursement for lost or delayed equipment, adding even more value.

- Extra tip: Rent gear off-mountain.

- Local rental shops (not at the base of the resort) typically charge 20–40% less for skis, boots, and boards.

- Reserve online in advance to lock in lower rates and ensure availability during peak weekends.

4. Hawaiian Luaus

Why it’s pricey: Luaus often run $150+ per adult and $100 per child — and that adds up fast.

How to save smarter:

- Book on points, charge to your room: If you’re staying at a resort like the Grand Hyatt Kauai on points, charge the luau to your room. Then erase it later with your travel credits or statement offers.

- If you’re going to pay for a Luau, try to go through sites like Viator and use a shopping portal like Rakuten to earn up to 10X the points on your purchase.

- Famous ones like Old Lahaina (Maui) or Paradise Cove (Oʻahu) are amazing but pricey. Smaller or community-run luaus—like those at cultural centers, hotels, or local churches—often cost half as much and still offer authentic performances and food.

- Find free alternatives: Many resorts host complimentary cultural nights, hula lessons, or lei-making classes. You’ll get the Hawaiian spirit for free — no buffet required.

- Look for combo or “activity pass” deals Companies like Go City (Oʻahu, Maui) or Hawaiian Discount Activities include luaus in their multi-activity passes. If you’re planning snorkeling or ATV tours too, you can save 20–30% overall by bundling.

- Eat elsewhere and buy a show-only ticket Some luaus offer a “show only” option (no dinner) for a lower price—perfect if you just want to see the fire dancers and music without the buffet markup.

- Choose weekday shows Luaus held on weeknights (Mon–Thurs) are often cheaper and less crowded than weekend ones. Bonus: you’ll have better seats and more relaxed vibes.

Planning a Hawaii trip with your family? I’ve pulled all of our Hawaii itineraries, hotel stays, and island guides into one place here: Hawaii on Points and Miles (Complete Family Guide)

5. Boat or Whale-Watching Tours

Why it’s pricey: A half-day family tour can easily cost $400+.

How to save smarter:

- Book through transfer partners: Chase and Capital One both partner with platforms like Expedia or Viator — so you can redeem your points directly for tours.

- Bundle activities: Some hotels offer activity credit packages where you can redeem points for both your stay and your excursions.

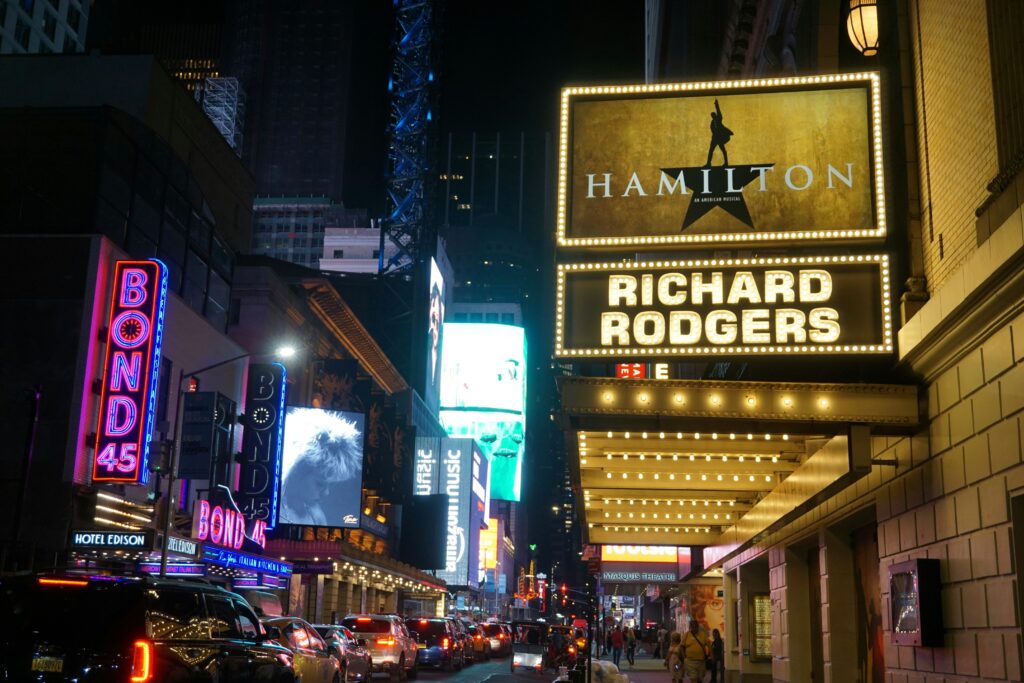

6. Broadway or West End Shows

Why it’s pricey: Tickets for four can be $600+ once you factor in fees.

How to save smarter:

- Use cardholder experiences: Amex, Chase, and Citi all offer exclusive access or discounted tickets through their experiences programs.

- Rush Tickets & Digital Lotteries Enter same-day lotteries or line up early for “rush” seats — you can snag $30–$50 tickets to major shows that normally cost $150+.

- TKTS Booths or Same-Day Apps (like TodayTix) Grab same-day tickets at 20–50% off. Be flexible with your show choice for the biggest savings.

- See a Preview or Weekday Matinee Tickets for previews (before official opening) or midweek matinees are often way cheaper — and the performances are just as good.

- Use Discount Sites & Promo Codes Check BroadwayBox, TodayTix, and TheatreMonkey for legit promo codes and deals before you buy anywhere else.

- Earn points on entertainment: Use a card that earns a bonus on live events — then redeem those points toward your next trip.

7. Resort Add-Ons

Why it’s pricey:

- Daily extras like cabanas, spa treatments, breakfast, parking, and resort fees can quickly add hundreds to your bill.

- It’s often not the room that costs the most—it’s the add-ons.

How to save smarter:

- Book through luxury collections with built-in perks:

- Programs like Amex Fine Hotels & Resorts, Visa Infinite Hotels, and Chase Luxury Hotel Collection often include:

- Daily breakfast for two

- $100+ resort or dining credit

- Guaranteed late checkout

- Complimentary room upgrade at check-in (when available)

- These benefits can offset higher nightly rates and give you elite-style perks without elite status.

- Programs like Amex Fine Hotels & Resorts, Visa Infinite Hotels, and Chase Luxury Hotel Collection often include:

- Split your strategy: use points and travel credits:

- Pay for your base stay with points.

- Use annual travel credits from premium cards toward extras like spa services, cabanas, or on-site dining.

- This approach lets you save cash while still enjoying resort amenities.

- Check for resort fee waivers on award stays:

- Many hotel programs waive resort fees when you book with points, which can save $40–$60 per night. I’m looking at you Hyatt and Hilton!

- Always verify this before booking to maximize your redemption value.

- Consider splitting your stay:

- Use points for nights when you plan to enjoy resort amenities. This can be especially helpful when traveling to places like Hyatt Ziva Cancun or other resorts where. you are paying a ton of points per night to stay there. Consider staying your arrival and departure day at a local Hyatt that is considerably less points per night.

Final Thoughts

Family trips don’t have to drain your wallet — they just take a little strategy. These are the exact tactics we use to make our adventures affordable, whether it’s a Kauai luau, a whale-watching tour, or front-row Broadway seats in NYC.

The truth? You don’t have to skip the bucket-list experiences. By earning the right points, redeeming them for high-value stays, and stacking every available offer, you can enjoy it all — without the sticker shock.

Watch it Now

Opinions expressed here are the author's alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.

I found out about points and miles accidentally.

I was researching index funds and happened upon the points and miles community through creators who also post about budgets, financial independence, and investing.

Points and miles allowed those people to travel and work toward financial independence simultaneously.

Thank goodness I got started when I did. The past almost two years of travel have been something we will never forget.

Earning points and miles through credit cards is only a good choice if you have the financial discipline to use them, like cash/debit cards.

Since we started traveling with points and miles, we have had more money going into our investment and savings accounts than ever.

Now I'm excited to teach you!

Welcome

I am excited you are here

New to points and miles? START HERE!